The Adani Group passed off lower-quality coal as a far more expensive, cleaner fuel in transactions with an Indian state-owned power utility. This is according to evidence obtained by the Financial Times which brings to light allegations of a long-running coal scam.

The documents, secured by the Organized Crime and Corruption Reporting Project (OCCRP) and reviewed by the FT, add a potential environmental dimension to the corruption allegations surrounding the Indian conglomerate. They suggest that Adani may have fraudulently made record profits at the expense of air quality, as using low-quality coal to produce energy means burning more fuel.

Invoices show that in January 2014, Adani bought an Indonesian consignment of coal that allegedly contained 3,500 calories per kilogram. The same shipment was sold to the Tamil Nadu Generation and Distribution Company (Tangedco) as 6,000-calorie coal, one of the most valuable grades, and Adani appears to have more than doubled its money after deducting transportation costs.

The FT has also cross-referenced documentation for a further 22 deliveries in 2014 involving the same parties, indicating a pattern of grade inflation in the delivery of 1.5 million tonnes of coal.

Adani sourced the coal in Indonesia from a mining company known for its low-calorie production at prices comparable to lower-quality fuels. It supplied the coal used to generate electricity to India’s southernmost state, fulfilling a contract that called for expensive, high-quality fuel.

Outdoor air pollution kills more than 2 million people in India every year, according to a 2022 study in The Lancet, while other studies have found significant increases in child mortality within hundreds of kilometers of coal-fired power plants.

Another study a decade ago found that coal-fired power plants, which provide about three-quarters of India’s electricity, produced about 15 percent of the country’s human-caused particulate matter emissions, 30 percent of nitrogen oxides and 50 percent of sulfur dioxide.

“Public health has definitely taken a backseat to the interests of the energy sector in India,” said Sunil Dahiya, a New Delhi-based analyst at the Center for Research on Energy and Clean Air.

Opposition politicians called for an investigation into Adani last year after the FT reported that the company had paid more than $5 billion to middlemen for coal imports into India between 2021 and 2023, far above market prices.

The latest revelations come as Adani seeks to become a major player in renewable energy, including by building one of the world’s largest wind and solar farms in Khavda, near the Pakistani border. The group, which denies wrongdoing, remains one of India’s largest coal importers.

The results are also likely to add to an intensifying political debate in India over the power and influence of billionaires, including Gautam Adani, whose name and vast wealth have emerged in the current election campaign in which Narendra Modi is seeking a third term as prime minister.

The Directorate of Revenue Intelligence (DRI), the Indian finance ministry’s investigative arm to combat economic crimes, launched an investigation into coal prices in 2016. The prosecution of a businessman in connection with an alleged $68 million coal price inflation case is one of the few tangible results of this ongoing investigation.

New documents obtained by the OCCRP and obtained by the FT show that the ship MV Kalliopi L left Indonesia in December 2013 with coal whose list price was $28 per tonne. When it arrived in India in the new year, Adani sold the coal to Tangedco for $92 a tonne.

The coal came from the operations of the Indonesian mining company PT Jhonlin in South Kalimantan, where the ship was loaded.

An export declaration by PT Jhonlin listed Tangedco as the final buyer and Adani’s details as the intermediary. However, Jhonlin’s bill went to British Virgin Islands-based Supreme Union Investors, which charged $28 per ton.

A week later, Supreme Union Investors Adani in Singapore invoiced the shipment at $34 per ton, saying the coal contained 3,500 calories per kg.

On Adani’s subsequent invoice to Tangedco, the quality rose to 6,000 calories – as did the price to $92 per tonne.

Other documents suggested the discrepancy was not an isolated incident. A 2014 order lists 32 shipments of 6,000-calorie coal by Adani to Tangedco, totaling 2.1 million tons at $91 per ton. The order was released under India’s freedom of information laws at OCCRP’s request.

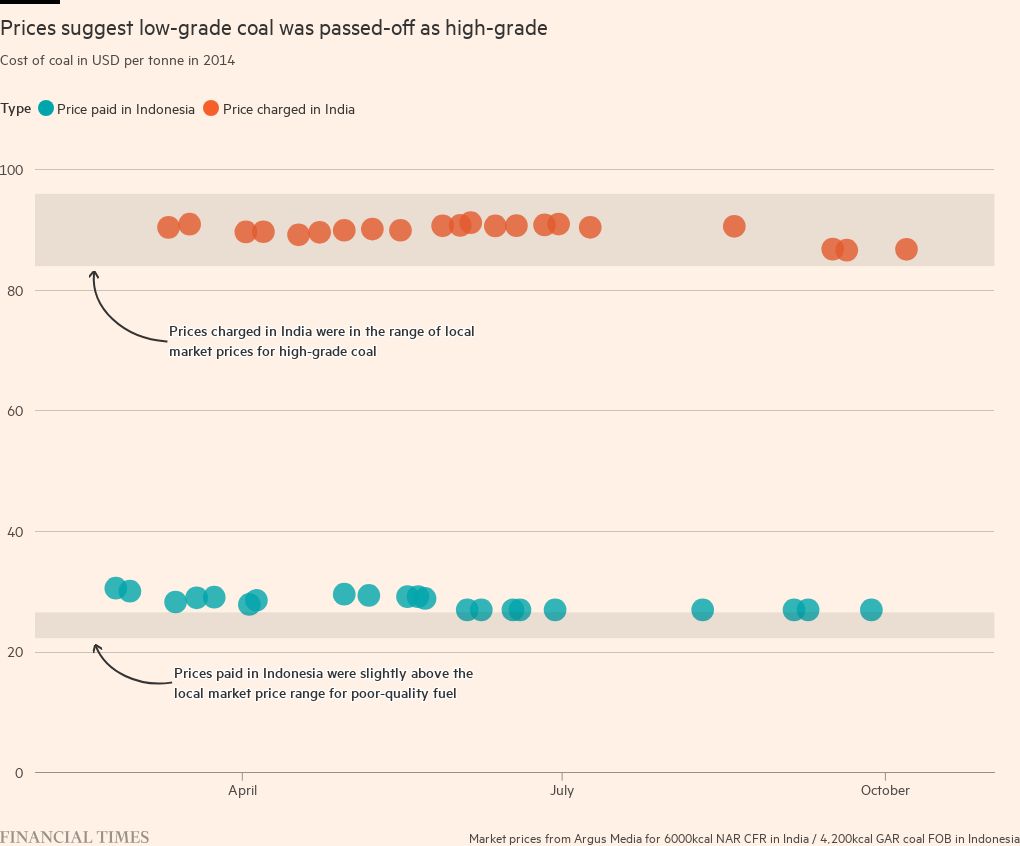

According to internal records kept by Jhonlin, Supreme Union Investors acted as an agent for 24 of the cargoes listed in Tangedco’s order, buying them at an average price of $28 per tonne. According to Argus, the cargo prices were slightly above the benchmark for 4,200-calorie coal from Indonesia, which was trading at $22-$26 per tonne at the time.

The FT was able to match 22 of the 24 trips with reports from India; Tangedco was the final buyer of all 22 shipments at an average price of $86 per ton. The price is in line with Argus estimates of local market prices for high-quality 6,000 calorie coal, which ranged from $81 to $89, including freight costs.

Argus’ current price estimates for freight costs suggest that Adani and its intermediaries shared up to $46 in profits for each tonne sold at an average price of $86. In total, the cost of the 22 trips was around $70 million.

Adani rejects the fraud allegations. A spokesman for the company said the quality of the coal was independently checked during loading and unloading, as well as by customs authorities and Tangedco scientists: “Since the delivered coal has undergone such an extensive quality inspection process by several authorities at several points, the allegation is the supply of inferior coal is not only unfounded and unfair, but completely absurd.”

Tangedco, Jhonlin, Supreme Union Investors and the DRI did not respond to requests for comment.

“Given the market power of coal suppliers [utilities] “Often we have no choice but to accept a drop in grades,” said Rohit Chandra, assistant professor of public policy at IIT Delhi. “Third-party testing has done very little to address these concerns.”

The transactions fit a pattern of endemic fraudulent price inflation alleged by Indian authorities in 2016 in a notice that listed five Adani companies supplied by the group and five importers among the 40 companies under investigation.

The DRI notice alleged that offshore middlemen were used to inflate the price of coal supplied to utilities and that “in a significant number of cases” two sets of test reports for supplies were discovered: “one with lower gross calorific value (GVC)” and “the other higher BVC”.

Arappor Iyakkam, a non-governmental organization based in Chennai, the capital of Tamil Nadu, alleged a “coal billing scam” in a complaint to the state’s Directorate of Vigilance and Anti-Corruption in 2018.

The non-governmental organization, which deals with transparency issues, said that Tangedco paid prices for coal that were higher than the market price and that the calorific value of the coal declared in tenders and orders did not correspond to the value actually delivered.

“Tangedco suffered heavy losses of [billions of rupees] every year for the last decade,” the NGO said in its complaint. “We need to understand that this directly leads to higher electricity tariffs for the common man and has a big impact on the common man.”

The NGO estimated that a total of 60 billion rupees ($720 million) was wasted in coal procurement by Tangedco between 2012 and 2016. “Given that Adani supplied about half of this, the loss caused by Adani alone would be Rs 3,000 crore ($360 million),” Jayaram Venkatesan, the NGO’s convener, told the FT.

Adani’s spokesman said the NGO had “rehashed the DRI allegations.” India is the world’s largest consumer and producer of coal after China. However, due to strong demand and rail bottlenecks, the country also has to import, as Indonesia is the largest supplier of thermal coal.

In a 2017 report, India’s auditor general questioned whether Tangedco’s bidding process for imported coal favored large corporations like Adani. It was pointed out that there was not enough time to submit offers and bidders had to set high turnover requirements. The DRI’s investigation is ongoing and is being delayed by legal proceedings related to international document requests.

Adani said the company felt vindicated by the DRI’s decision last year to withdraw an appeal to the Supreme Court in a case against one of the 40 importers named in 2016.

Industry analysts say testing of coal calorific value – including strict requirements for sampling coal racks – is rigorous and carried out by independent bodies in India. But since everything happens with human intervention, there is scope for abuse, they note. The test cost is usually shared between the supplier and the end user at the loading end and borne by the end user at the unloading end.

“A large discrepancy” between the declared calorific value of a shipment and its actual value “can only occur with the connivance of people at the unloading end,” a senior power sector official said.

Tangedco’s documents include several certifications from its own scientists and third-party testing firms that the coal supplied by Adani under the 2014 order met specifications.

A person working in India’s power grid said the main focus was on continuity of coal supply and balancing power generation to meet demand, meaning any coal quality issue was a “post hoc exercise.”

An Adani spokesman said: “No matter how much imagination you can [Adani’s Singapore subsidiary]with a total supply of less than 2 percent of the coal burned by Tangedco during the relevant period, will be blamed for either air pollution or the losses” of India’s state-owned power distribution companies.